When we were planning our move to Canada, we knew that one of the biggest expenses we’d have to plan for was our dogs. It’s already expensive enough to take care of one dog in Canada—and we have two! So, we expected it to be a big part of our monthly expenses.

Back in Malaysia, pet insurance wasn’t even something we thought about because vet care there was pretty affordable. But in Canada, with everything costing more, we figured it might be worth considering. So, we spent a good amount of time looking into it.

Researching Pet Insurance: What Other Pet Parents Told Us

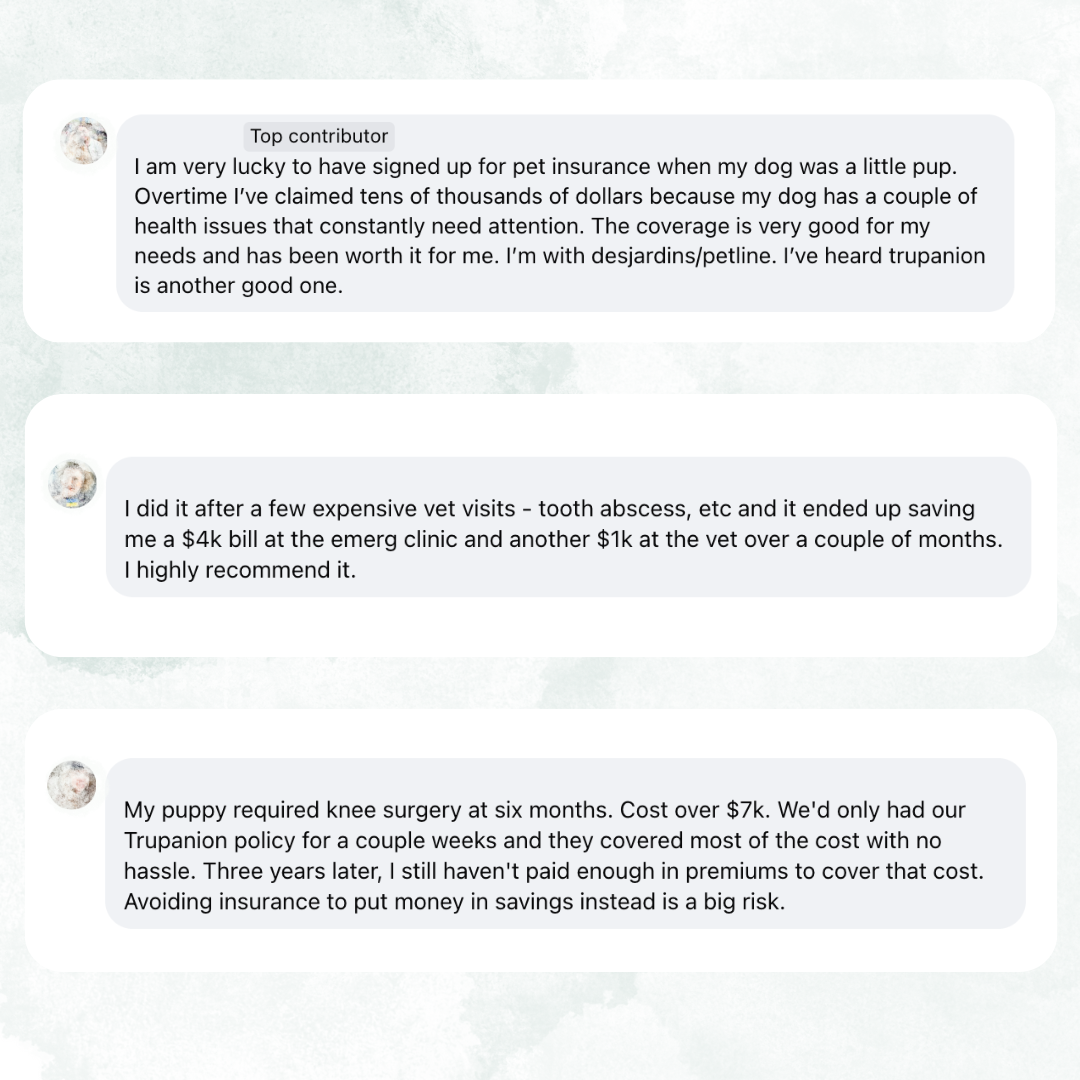

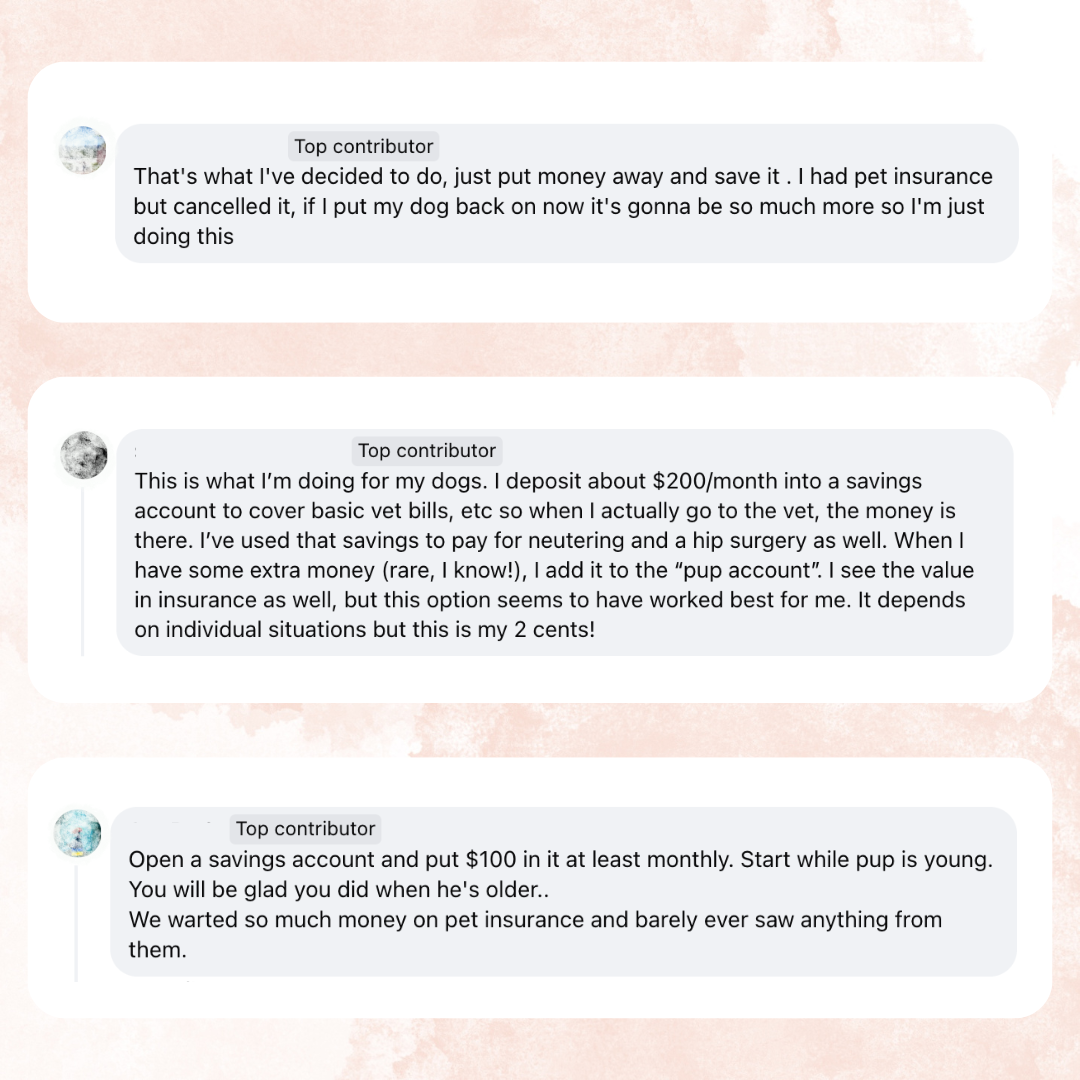

To start, I joined Facebook groups like Toronto Dog Moms to get honest opinions on pet insurance. I wanted to know if other dog owners thought it was worth it and, if so, which providers they’d recommend. I also struck up conversations with pet owners we’d meet at parks, asking for their thoughts. We got a wide range of answers, each reflecting different ways of managing pet care costs:

Yes, they signed up for pet insurance – A lot of pet owners got insurance when their pets were young. They viewed it as a safety net, knowing that an emergency could arise at any time, even if they might not need it every month or year. To them, it was worth the peace of mind.

No, they chose to save instead – Some people thought pet insurance was too expensive, so they decided to put away about $200 a month in a dedicated savings account for pet care. That way, they’d have funds ready when needed without paying monthly insurance fees.

Both approaches are valid, so we thought about what would work best for us. At first, we decided against pet insurance because we were already juggling other settling-in expenses, and we felt comfortable with the idea of putting aside cash for emergencies. We withdrew $500 in cash, put it in an envelope as our “pet fund,” and planned to add more each month.

Why We Changed Our Minds About Pet Insurance

But a few months later, we had an experience that changed our perspective completely and turned us into firm believers in pet insurance.

I’d finally decided to get pet insurance for both of our dogs. Hachi, our mixed breed, was already 7 years old, and Goose, our Shih Tzu was 4, so I knew the monthly premiums would be a bit higher. After researching, we saw lots of recommendations for Trupanion and Furkin. We ended up choosing Furkin because it was more budget-friendly for us, given all the expenses we were still managing in our early months in Canada.

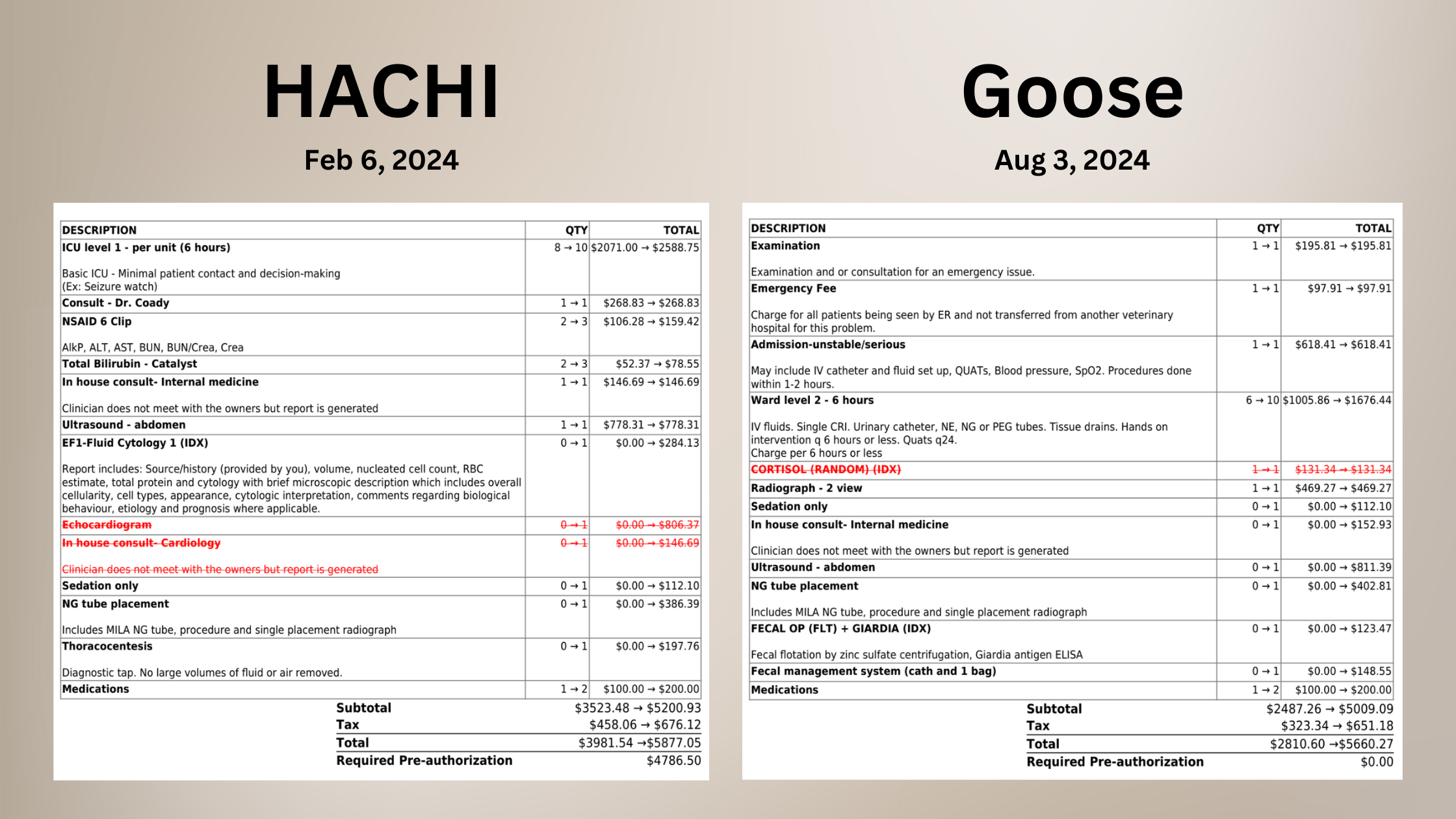

Then, just one month after enrolling in the insurance plan, Hachi got seriously sick. She went from being completely fine to lethargic and very unwell overnight. It was the first time we’d ever seen her like this. She was scheduled for her first routine vet check-up here in Canada the following week, but there was no way we could wait. We took her to the emergency animal hospital, where she needed to be admitted to the ICU.

When we checked her in, we were hit with a required pre-authorization of $5,000 estimate that had to be paid upfront. Our credit card limit was only $1,500, and most of our savings were still back home in Malaysia. We had to use nearly all the cash we had in our account to get her admitted.

It was a tough and stressful time, but we were grateful that we could cover it. However, $5,000 is no small amount—and it was almost everything we had in Canada at the time. We were really hoping our new pet insurance plan would come through. It was nerve-wracking to submit the claim because Hachi didn’t have any Canadian vet history, only her records from Malaysia. Thankfully, the insurance covered 80% of the bill, which helped us rebuild our savings and brought huge relief.

Just a few months later, Goose got sick with bloody diarrhea. We went to a regular vet first, trying to avoid the emergency hospital if possible, but her condition worsened, and she ended up needing urgent care. That hospital visit cost $2,500 (they printed a different estimate while we were there for Goose but we did a pre-authorization of $3,800), but thankfully, we got a portion of it reimbursed through our insurance.

Our dogs had been so healthy in Malaysia, and we never thought they’d face serious health issues so soon after we moved. Without pet insurance, we would’ve only had about $500 saved for that initial $5,000 bill, which would have been a serious financial strain, especially for new immigrants trying to get established in Toronto.

Our Key Takeaways on Pet Insurance and Managing Pet Costs

From our experience, here’s our perspective on whether pet insurance is right for you and some practical tips on managing pet expenses in Canada:

Consider Getting Pet Insurance – Yes, it’s another monthly expense, but it’s worth it for the peace of mind that comes with knowing you’re covered if an unexpected health issue arises. In Canada, vet bills can add up quickly, and insurance can help reduce the financial burden.

If You Prefer Not to Get Insurance, Have an Emergency Fund – Not getting insurance doesn’t mean you’re a bad pet parent. But do make sure you have some funds set aside for unexpected vet visits, as costs here can be high. It’s all about finding what works best for your situation.

Visit a Vet Soon After Moving – Take your pet to a vet soon after you arrive to get a general health assessment and start building a vet record in Canada. This history can make insurance claims easier if something happens down the line. After comparing a few options, we chose Yonge & Sheppard Animal Clinic because it’s close by, and they’re responsive in emergencies.

Build Up Your Credit Limit as You Go – After Hachi’s hospital visit, we realized we needed more financial flexibility, so we went to the bank to raise our credit limit. Having extra credit on hand helps in emergencies, and if you have insurance, you can use the reimbursement to pay down the balance without draining your savings.

Stay Calm During Pet Health Emergencies – When your pet is sick, it’s natural to panic, but try to stay calm and reach out to your regular vet first. As new immigrants, we didn’t want the added stress of big vet bills on top of everything else, so we learned to go to the emergency hospital only if absolutely necessary to help manage costs.

In the end, whether you choose pet insurance or not really comes down to what works best for you and your pets. For us, the unexpected health issues we faced made us really appreciate having that safety net. Sure, the cost of insurance can feel like an extra expense, but when things go wrong, it can really make a difference. Whether you decide to get insurance or just save up, the important thing is to be ready for those surprise vet bills. After all, our pets are family, and making sure they’re taken care of is always worth it.